Yes, I know you haven’t heard much from us here lately but we’re still alive! Life has just had a way of handing us things to do that have kept us from writing for this blog. We haven’t forgotten about you and we still have many topics on our minds that we’d love to write about if we had the chance. But alas, there are only 24 hours in a day!

At the very least, we want to give you our annual financial update on our numbers. But before we get to the details, here are a few significant occurrences during the year:

- We had a major air conditioning repair as well as a lawnmower breakdown right during the hottest days of summer when the grass grows an inch a minute. These cost us well over $1000.

- We bought a small utility trailer that cost nearly $500.

- I went on a massive spending spree (well over $1000 in the year) for my garden with tools, trees, equipment, etc. as I put out my orchard and expanded my garden.

- Our little girl is growing and now eats nearly as much as an adult! This means more cost in our groceries budget.

- Moreover, Deb intentionally tried to spend more money on groceries this year since we’re no longer in ultra-penny-pinching-mode anymore.

To compare with our previous annual reports, check out these links: 2016, 2015, 2014, and 2011-2013. (Is this the 5th one of these we’ve done already?!)

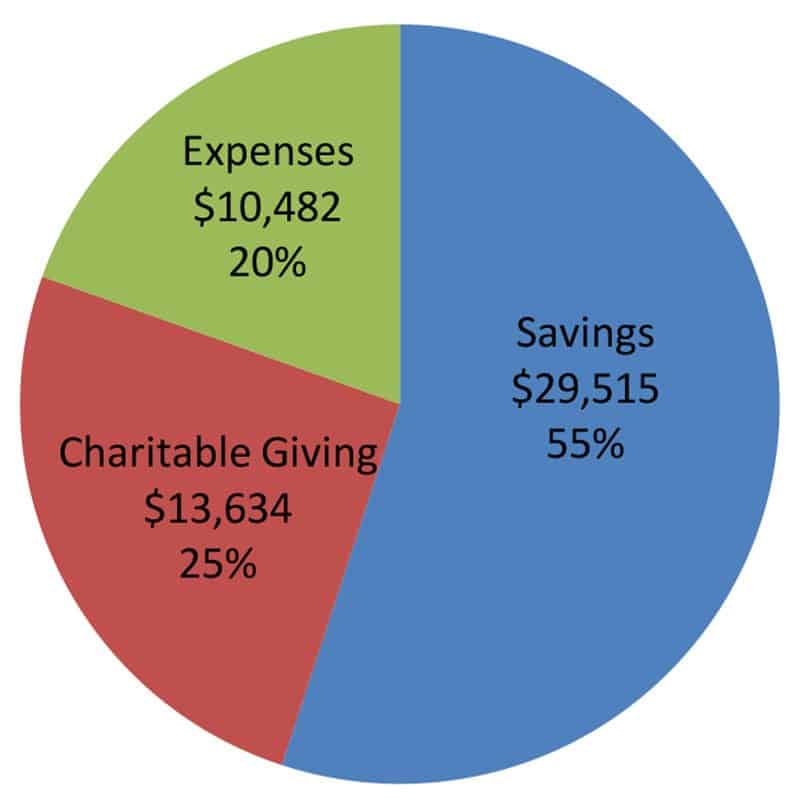

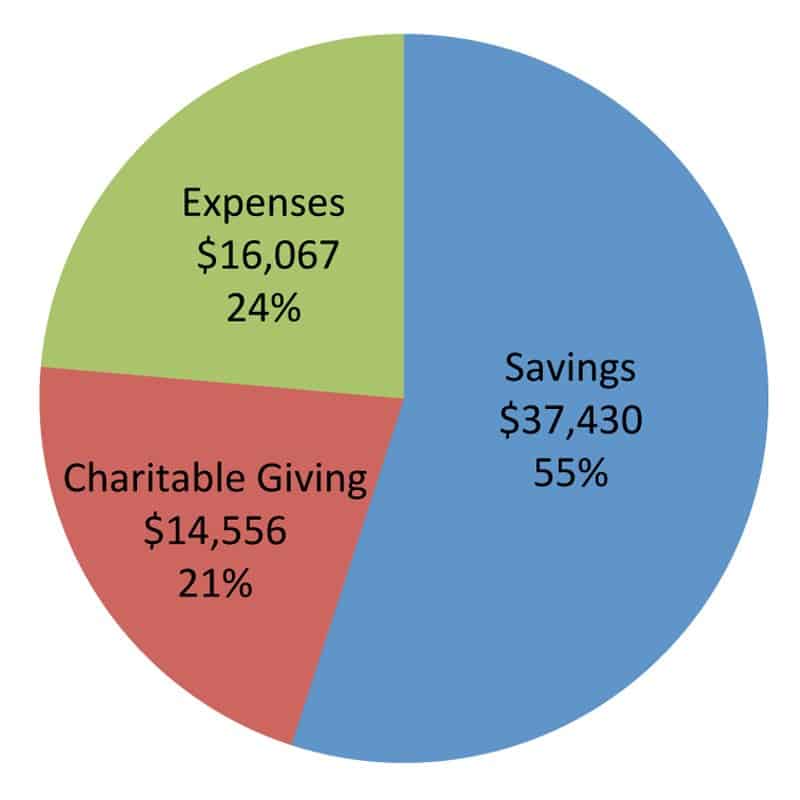

Without further ado, here are our numbers for 2017:

The Numbers

|

2017 |

2016 |

2015 |

|

| Total Income: |

$53,632 |

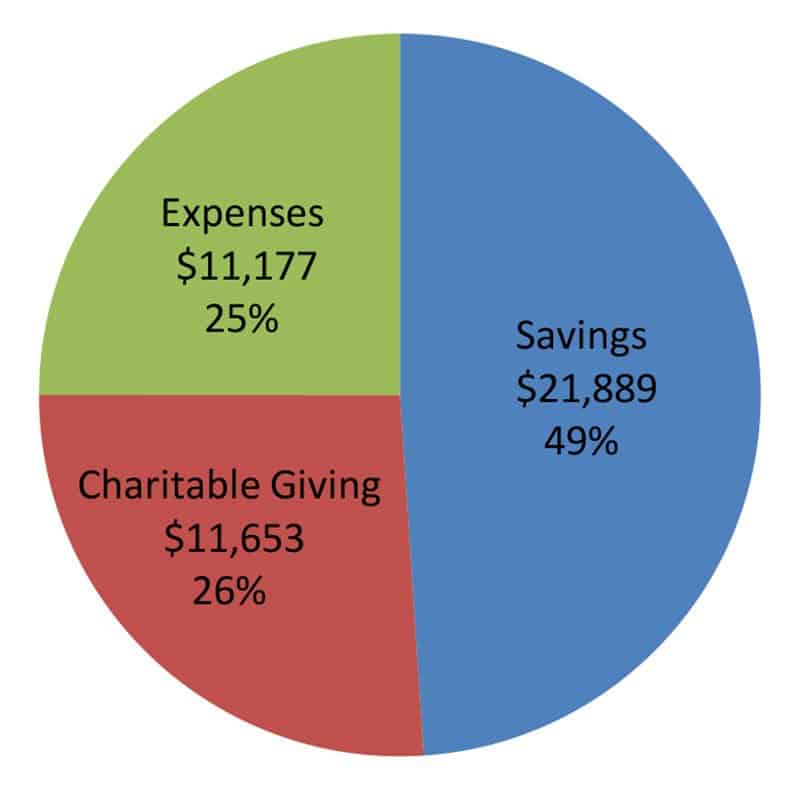

$44,719 |

$68,053 |

| Tithe/Charitable Gifts: |

$13,634 |

$11,653 |

$14,556 |

| Living Expenses: |

$10,482 |

$11,177 |

$16,067 |

| Net Income: |

$29,515 |

$21,889 |

$37,430 |

| Percentage Saved: |

55% |

49% |

55% |

|

2017 |

2016 |

2015 |

Analysis of the Numbers

- Right at the top, you notice that we had a fairly sizeable bump in our income for the year. While I did get a raise at work this year and we did pull some profit from this blog for the first time ever, those weren’t the biggest part of the increase. We got an unexpectedly large tax refund when we filed, and lest you think that it’s because I didn’t read my own post on this subject, we actually got significant tax credits so we got money back that we never paid in. I’m no tax expert and don’t know how that happened, but I’ll take it!

- We continued our goal of giving away at least 25% toward tithe and other charitable giving, and that’s why that number remained fairly level. Most encouraging to us was that the amount we gave away was significantly more than we spent for ourselves this past year.

- What’s most incredible to us is that not only did we spend LESS than what we did last year, but if you look back across all of our financial reports, we spent less this year than ANY previous year since we’ve been married!

- One big benefit that helped us reduce our spending from last year was that our Obamacare health insurance premium went DOWN in price for our family in 2017 where we essentially paid nothing after the subsidy. This cut out a significant chunk of expenses.

- We were SO close to coming in under $10,000 for the year, people! Just $500 shy, I can’t believe it!

If you look at our report from last year, you will see that we were amazed how little we spent in 2016. We didn’t really crunch the numbers throughout 2017 because we thought for sure there’s no way we could match the previous year. But when we tallied things up at the end of 2017, we were amazed that we did even BETTER than the year before with even less effort.

So I guess the stuff we preach about here actually works? (I know, it’s kinda weird that we would be surprised by that, right?)

Disclosure: Two Large Purchases from our Savings

The numbers we share above basically comprise our annual income (or profit-loss) statement. What it does NOT reveal is our actual cash flow for the year. That’s typically reserved for a cash-flow statement in businesses, but since we don’t provide that nor our balance sheet, it may not show the full picture. The reason we don’t share all of that, besides maintaining some measure of financial privacy, is because we try to make sure the numbers we share are accurate representations of what we spent to live from day-to-day, and that the picture is not skewed with large capital expenditures that occur from time-to-time from our savings. Nevertheless, in full disclosure, I want to let you know about two significant purchases we made in the year that came out of our savings that we didn’t include in the numbers above.

- Shed. As alluded to above, we expanded our agricultural pursuits at our home this year with a small orchard and other gardening initiatives. This simply meant buying more stuff. So to store all the additional gear, we bought a 16’x10’ garden shed for $3000. I share this with a bit of embarrassment because in many parts of the world, people raise entire families in 160 square feet of space! (Not to mention the tiny house movement.) And I’ve got that much space sitting in my yard just to hold my junk…so you see, even we Crumb Savers are living large and succumbing to lifestyle inflation!

- Minivan. Yes, we did it. We bought a minivan. Perhaps we’ll have a chance to tell you the story of the van another time, but we got a used, low-mileage 2014 Honda Odyssey for $18,500 after all taxes, registration, etc. It was significantly below blue book value, but still a big chunk of change for us. This is a purchase for which we’ve been saving up a long time, and this year we finally pulled the trigger.

These two purchases totaled $21,500 that came out of our short-term savings funds. If we were to include these into our annual expenses above, our total savings for the year would have dropped to around $8000 and we would have ended up with a 15% savings rate for the year. Feel free to take these numbers as more accurate, if you’d like.

Living on $10,500

The reason why our household expenses continue to remain low with minimal effort on our part is because we’ve applied the strategy of trimming large and recurring expenses from our budget. Our savings don’t come about from spending an inordinate amount of time and effort pinching pennies at the check-out line or the Amazon shopping cart. It is the result of years of strategic cost-cutting in the areas that have impact on an ongoing basis. Here are some of the big ones:

- Mortgage. As we’ve documented before, we paid off our house in 2015—exactly 2 years to the day from when we closed on it. Having lived with no rent or mortgage payments for over 2 years now, we’ve kind of forgotten what it’s like to have to pay for housing. But housing is the largest expense for most people (anywhere from a quarter to half of the income!), having no mortgage is the single greatest reason why our living expenses are so low. Check out our previous posts to read about our story and see how we did it.

- Utilities. With our investment in solar panels, our monthly electric bill still amounted to $0 for the year. Actually, we’re still getting paid on average each month for our electric bill. The reality is that solar panels aren’t going to be a solution for everybody, but reducing energy usage is certainly something everyone should do to cut back on a recurring expense. You can check out our latest annual solar panel update to see how we did this year.

- Auto Insurance. For much of 2017 we were still driving our old, reliable 2002 Honda Accord that’s worth less than $2500 Blue Book value. That means we only bought the minimum liability insurance needed and paid around $30 per month. With our minivan purchase, our insurance cost did go up and so this amount will likely be higher in coming years.

- Health Insurance. We switched to Obamacare in 2016 from Medi-Share since with the addition of a 3rd member in the household, we qualified for the lower rates. As mentioned above, we got a larger subsidy in 2017 which, coupled with an employee health insurance benefit I receive from work (which wasn’t applicable to Medi-Share), our health insurance premium essentially went to $0. This is huge. So of course we seized the moment and maxed out as much as we could into our HSA.

- Cellphone Service. We are still using Cricket Wireless for $40 per month for unlimited everything for 2 iPhones. Cricket recently updated their plans and raised prices, so the plan we are on is no longer available for new customers. They are grandfathering us in at our existing price, so we’ll stick with them for now. But you can be sure that I’m keeping my eyes open for other better options.

- Other Recurring Expenses. Here are some other recurring expenses we have: Life insurance, home insurance, property tax, fire department fees, garbage disposal, water. Some of these are tough to reduce, but we do try whenever the opportunity presents itself.

When I tally up all of these combined recurring expenses, around $413 goes to these things each month. That’s just a hair under $5,000 a year for all of these significant and recurring expenses. For a seminar I did recently, I estimated that the average cost for these exact things for a similar household in my area could run as high as over $30,000 a year! We will never be able to bring our expenses down if we don’t tackle these big items in our budget.

Breaking It Down Monthly

So let’s take a look at our monthly expense categories broken down to our average monthly spending to see how these numbers look on a month-to-month basis.

|

Categories |

Annual Total |

Monthly Average |

Notes |

| Housing & Utilities |

$3,168 |

$264 |

Home insurance, property tax, garbage, water, fire dept, cellphone. (NO mortgage or electricity!) |

| Insurance |

$1,116 |

$93 |

Health insurance, auto insurance, life insurance, etc. but not home insurance |

| Automobile |

$672 |

$56 |

Gasoline, oil changes, vehicle maintenance, registration |

| Household Supplies |

$2,160 |

$180 |

Household, cleaning, tools, personal hygiene, and misc. |

| Yard and Garden |

$1,356 |

$113 |

I spent so much in this category this year that we decided to split it out as a new category in 2017. Most of this was due to the large amount I spent in planting out my orchard. |

| Groceries |

$1,116 |

$93 |

Includes groceries, but not eating out. Dining out is classed under “Recreation”. |

| Recreation |

$588 |

$49 |

Eating out, gifts for people, and other fun things. |

| Baby |

$276 |

$24 |

Includes all purchases related to the baby. Diapers, shoes, toys, shoes, clothes, shoes… (LOTS of shoes!) |

| Total: |

$10,482 |

$874* |

*This number may not add up exactly due to rounding. |

A Few Comments

- Auto. Our auto expenses went up a fair bit from last year because the minivan costs more, and there were a number of upfront costs when we got the car. Part of the cost of a growing family!

- Groceries. This is the one that we always get asked about. Our previous baseline for groceries was around $60/month. So this year represented an approximately 50% increase from that baseline. Well, the number of mouths in our house also grew by 50%, so we feel that this isn’t a disproportionate increase. We average roughly $30/person a month, so that’s about $1 per person per day. That’s not always possible for many people, so the recommended target I generally give to people to shoot for is $1 per meal per person. That would be roughly $90/person each month.

- Baby. With our little girl no longer a baby but an active toddler, there have been a lot of additional expenses associated with that. If you look at our house, you will see no shortage of “kiddie litter” scattered hither and yon. But somehow, we barely spent anything to fill our house with so many toys and little girl paraphernalia. The secret is shopping at thrift stores. No joke, we’ve come home sometimes with what seems like an entire carload of kid stuff all for just a couple bucks. Toys, clothes, shoes, you name it—thrift stores are essential for any parent with little kids.

Don’t Forget the Savings

Because of our reduced levels of spending, that means our rate of savings has bumped back up to the 55% level. That’s nice and all, but where is all that money going? We don’t believe in hoarding, so these savings must be for some future need.

- HSA. As we mentioned before, we got a high-deductible health plan (HDHP) so that we can save into a Health Savings Account. The HDHP also happens to be how we keep our Obamacare health insurance premium so low, but at the cost of an extremely high deductible. (Over $5000/person, and over $12,000 for the family!) The HSA is the solution where we can save up enough to cover the deductible, plus let the excess grow. It is the most tax-advantaged type of saving account available with a triple tax benefit. So we prioritize maxing out our HSA account, which had a limit $6750 for 2017. (This limit goes up to $6900 in 2018.)

- Roth IRA. We also maxed out our Roth to save toward retirement. We should be able to max out both accounts this year for a total of $11,000. We’ve written previously about a Christian perspective on saving for retirement, plus some thoughts on retirement accounts.

- College Savings. We also continue putting away $250 a month toward our daughter’s college savings fund, plus any gift money that she received. We opted for a regular taxable account with Vanguard rather than a 529 or ESA. You can read more about our thoughts here.

- Home Improvement. After socking money away into those three areas, we still have $8765 remaining for the year. This amount will go toward additional home improvements that we have on our wishlist.

Most of our savings are set to be completely automated from month-to-month, so it takes no thought or effort to make that large transfer every month. This also means I’m not tempted to spend all that money since it’s automatically deducted from my account! It’s also a nice surprise to peek at our account totals after ignoring it for a while to see how much our net worth has increased without our knowledge.

To see how we think about goal-oriented and savings-driven budgeting, check out our post on How to Budget for Maximum Savings.

Wrapping Up

What’s ahead for the Crumb Saver household in 2018? Who knows! But one thing is certain, our financial plan has more or less been running smoothly because our life has been quite stable the past few years. The real test will come if there are major upheavals or significant changes. I’m certainly not wishing for that to happen, but until then, these annual budget reports might become quite boring!

So much of our personal finances are on auto-pilot now that it was actually a bit of a challenge to put this post together since we haven’t been thinking about these things as routinely as in the past. And that’s perhaps the biggest lesson of all I’m taking from this year’s financial report, that the effort expended to get on the right track early on will result in continuous savings down the road. So while it’s not possible for everyone to spend as little or save as much as what we are doing now, I believe it WILL get easier with diligent effort, continued persistence, and strategic decisions.

So how did 2017 look for you? What other tips do you have for saving more in 2018?